Nj Contractor License Application 2004-2026 Form

What is the Home Improvement Contractor Registration in New Jersey?

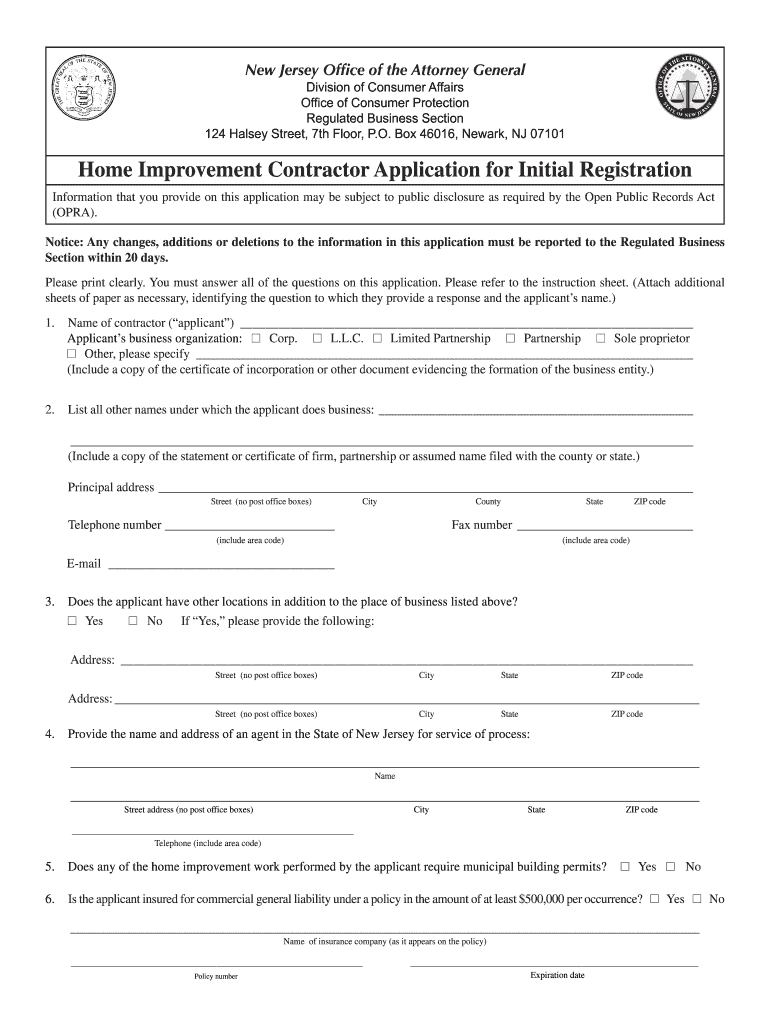

The Home Improvement Contractor Registration in New Jersey is a legal requirement for contractors who perform home improvement work. This registration ensures that contractors meet specific standards and comply with state regulations designed to protect consumers. It covers various activities, including renovations, repairs, and alterations to residential properties. By obtaining this registration, contractors demonstrate their commitment to professionalism and adherence to industry standards.

Steps to Complete the Home Improvement Contractor Registration in New Jersey

Completing the Home Improvement Contractor Registration involves several key steps:

- Gather Required Documents: Collect necessary documentation, including proof of identity, business registration details, and any relevant licenses.

- Complete the Application Form: Fill out the New Jersey contractor license application, ensuring all information is accurate and complete.

- Submit the Application: Submit the application online or via mail, along with any required fees.

- Await Approval: After submission, the application will be reviewed by the appropriate state department, and you will be notified of your registration status.

Required Documents for the Home Improvement Contractor Registration

To successfully register as a home improvement contractor in New Jersey, you will need to provide several documents, including:

- Proof of identity, such as a driver's license or state ID.

- Business registration documents, if applicable.

- Proof of liability insurance coverage.

- Any additional licenses or certifications relevant to your specific trade.

Eligibility Criteria for Home Improvement Contractor Registration in New Jersey

Eligibility for the Home Improvement Contractor Registration includes several criteria that applicants must meet:

- Applicants must be at least eighteen years old.

- They must provide proof of a valid business entity, if applicable.

- Contractors must have liability insurance as mandated by state regulations.

- Any prior violations of contractor regulations may affect eligibility.

Legal Use of the Home Improvement Contractor Registration in New Jersey

The legal use of the Home Improvement Contractor Registration ensures that contractors operate within the framework of New Jersey law. This registration allows contractors to legally perform home improvement work, providing consumers with confidence in their services. It also establishes a formal process for addressing disputes between contractors and homeowners, reinforcing accountability in the industry.

Form Submission Methods for the Home Improvement Contractor Registration

Contractors can submit their Home Improvement Contractor Registration application through various methods:

- Online Submission: Many contractors prefer to submit their applications online for convenience and faster processing times.

- Mail Submission: Applications can also be mailed to the appropriate state department, though this method may take longer for processing.

- In-Person Submission: Contractors may have the option to submit their applications in person at designated state offices.

Quick guide on how to complete home improvement contractor application for initial registration

Handle home improvement contractor application for initial registration from anywhere, at any moment

Your regular business activities might necessitate extra attention when managing state-specific business documents. Reclaim your working hours and reduce the expenses linked to document-based processes with airSlate SignNow. airSlate SignNow provides you with an array of pre-loaded business documents, including nj contractor license application, which you can utilize and share with your business collaborators. Handle your nj home improvement contractor license application effortlessly with powerful editing and electronic signature features and send it directly to your recipients.

Methods to obtain nj contractor license application online in just a few clicks:

- Select a form pertinent to your state.

- Click on Learn More to view the document and confirm it is accurate.

- Choose Get Form to begin working with it.

- nj home improvement license application will seamlessly open within the editor. No further actions are necessary.

- Utilize airSlate SignNow’s advanced editing tools to complete or alter the form.

- Locate the Sign tool to create your personalized signature and electronically sign your form.

- When prepared, click on Done, save your modifications, and access your document.

- Transmit the form via email or SMS, or use a link-to-fill option with your associates or allow them to download the document.

airSlate SignNow greatly saves your time managing [SKS] and enables you to locate vital documents in one place. A comprehensive library of forms is organized and designed to encompass essential business operations required for your organization. The sophisticated editor minimizes the chance of mistakes, as you can swiftly correct errors and review your documents on any device before dispatching them. Start your complimentary trial today to discover all the benefits of airSlate SignNow for everyday business workflows.

Create this form in 5 minutes or less

FAQs nj general contractor license application

-

Can I fill out the application for the improvement exam in math? How can I get a form for the improvement exam?

If you have attended all the exams this year (2018) in CBSE boards and pass all the subjects but not satisfied with your marks / want to improve your performance in any subjects then you can apply for CBSE improvement examination 2019, the applications will be released on CBSE by the third week of september this year, wish you best of luck…

-

What can I do if I have logged in to the AFCAT application form by doing the registration, but after clicking on the AFCAT option the application form is not opening for filling out further details?

You have to click on the first option below AFCAT category. Those will be the instructions. Read all of them & then proceed further.Don’t make any mistake in haste. Fill out all the details very carefully.Last date to apply is 23rd January 2018.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Related searches to nj home improvement contractor application for initial registration

Create this form in 5 minutes!

How to create an eSignature for the nj home improvement contractor license renewal online

How to create an eSignature for your Nj Home Improvement Contractor Application For Initial Registration Form in the online mode

How to generate an electronic signature for the Nj Home Improvement Contractor Application For Initial Registration Form in Google Chrome

How to create an eSignature for putting it on the Nj Home Improvement Contractor Application For Initial Registration Form in Gmail

How to create an electronic signature for the Nj Home Improvement Contractor Application For Initial Registration Form straight from your mobile device

How to generate an eSignature for the Nj Home Improvement Contractor Application For Initial Registration Form on iOS devices

How to create an eSignature for the Nj Home Improvement Contractor Application For Initial Registration Form on Android devices

People also ask nj contractor license

-

What is the nj contractor license application process?

The nj contractor license application process involves several steps, including gathering necessary documents, completing the application form, and submitting it to the appropriate licensing authority. It is crucial to ensure all information is accurate to avoid delays. airSlate SignNow can streamline document management during this process, allowing you to sign and send applications seamlessly.

-

How can airSlate SignNow assist with my nj contractor license application?

airSlate SignNow provides an efficient way to manage your nj contractor license application. With features like eSignatures and document templates, you can complete applications quickly and efficiently. This saves time and helps ensure all required signatures are obtained before submission.

-

What are the costs associated with using airSlate SignNow for my nj contractor license application?

The pricing for airSlate SignNow is designed to be cost-effective, making it accessible for contractors looking to submit a nj contractor license application. Various plans are available to fit different business needs, and you can choose one that aligns with your budget. This allows you to leverage powerful document management features without overspending.

-

Can I track the status of my nj contractor license application with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your nj contractor license application easily. You can receive notifications when your documents are opened or signed, providing peace of mind during the application process. This level of tracking ensures you stay informed every step of the way.

-

What documents do I need for the nj contractor license application?

To complete the nj contractor license application, you typically need documents such as proof of identity, business registration, and proof of experience. Ensuring you have these documents ready will expedite the application process. airSlate SignNow can help you organize and securely store these documents for easy access.

-

Does airSlate SignNow support multiple integrations for my nj contractor license application?

Absolutely! airSlate SignNow supports various integrations with popular software tools, which can seamlessly enhance your nj contractor license application process. Whether you need to import data from accounting software or connect with CRM systems, airSlate SignNow makes it easier to work within your existing workflows.

-

What benefits does airSlate SignNow offer for submitting an nj contractor license application?

Using airSlate SignNow for your nj contractor license application provides numerous benefits, such as enhanced efficiency, reduced paperwork, and quicker transaction times. You also gain the ability to securely store and manage all associated documents in one location. This not only improves your productivity but also ensures you can focus on your contracting business.

Get more for nj hic license application

- One time forgiveness benefit application osu hr the form

- How to write a letter of recommendation fast templates form

- Internship training plan form

- Michigan for employees who will have access to substances form

- Crosby tugs llc form

- Sf1411 form

- Sf 254 form

- Language handbook 1 worksheet 7 answer key form

Find out other nj hic application

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors